What’s a compelling offer?

This is a question I get a lot when my clients get to this part of their Virtual MBA curriculum included in our online Business Academy. While it’s all explained in their classes, it’s typically the first time they’ve heard this concept. Of course, they know what it means – it’s pretty straightforward. They simply need some examples to understand what it is and what it’s NOT.

Let’s be clear: a compelling offer is NOT what you see and hear in typical advertising. It’s NOT a discount, it’s NOT a sale, it’s NOT “free estimates”, it’s NOT “family owned”, or “call today” or “best selection”, “greatest volume”, “lowest prices”, or any of the typical platitudes you see and hear in your daily bombardment of traditional advertising.

No, a compelling offer is, well, compelling. It means an offer that compels people in market for what you sell to take action. It’s that simple. It’s the competitive aspect of marketing that makes your offer the “no-brainer” solution to consumer buying issues in your genre.

But devising a compelling offer is not always so simple. What usually is involved in a compelling offer is knowledge and creative thinking. The knowledge generally comes from knowing your costs, Yep, you must know what your TOTAL cost-of-sale is. That means not just what you paid for it plus your mark-up, but what you paid for it, your costs included in any sales commission, administrative costs, and even fixed costs like building lease payments, insurance, and all the associated costs of running your business.

If you’re not factoring in all your variable costs plus your fixed costs and plugging your margin into the total number, then your profit isn’t what you think it is. That will affect your cashflow negatively. That’s why it’s not uncommon for my Advisors to hear “How come my CPA says I’ve got a profitable business, yet I’ve got no cash?”

Figuring out how to get a true profit margin is in another post. For now, we’ll assume you’ve got your costs and profit aligned with your products and/or service margins. So, you’re now ready to continue building your compelling offer(s).

Next comes vendor negotiations. Can you get a discount for buying bulk? How about guaranteeing a certain volume or similar for a reduced cost? Ask your vendors. In today’s world of escalating prices, vendors are keen to keep the business they have, and many will provide some sort of deal just for asking. Especially if you tell them you are revisiting supplier agreements in an effort to cut costs. Most will give you a 10% discount right off the top.

Think about that: if you’re spending $25,000 annually with a supplier, a 10% discount is saving you $2,500. While that may not seem like a lot, that is 100% profit in your pocket. If you’ve got a 10% net/net margin, that 10% supplier discount is 10x your profit margin. That means you’d have to sell $25,000 worth of products or services to put $2,500 in the bank. You just did that with one vendor telephone call.

Can you think of some things you could do with an extra $2,500? Do that with all your vendors and you might be surprised at what suppliers will offer to keep your business.

“It never occurred to me to look at upstream and downstream vendors to build a compelling offer my competitors wouldn’t know how to match. I got calls from a couple of them wanting to know if I was trying to run them out of business. This was the easiest improvement I ever made in my sales effort, and it didn’t cost me an extra dollar to do it.”

John D. Weber

You might also find some surprises that lead to compelling offers for your business. Here’s an example:

A sunroom builder and all of his competitors buy the same products from the same wholesaler. They all build the exact same sunroom and sell it for the exact same price. There is absolutely no difference in quality, materials, price, or craftmanship. So, the builder is telling me “You can’t help me. There is no difference to promote.”

But all is not as it seems. I asked the builder, “So, what is the next thing people buy after buying a sunroom?” The builder just looked at me. “Huh? What do you mean?”

“Well, people don’t sit on the floor in an empty room, do they?”

Through the Business Academy training, the builder learned techniques for negotiating a better deal than his competitors. He also learned through the Academy how to negotiate “upstream” and “downstream” products and services. That means working with vendors that supply products or services that naturally fit before or after the main purchase.

The builder negotiated with a furniture wholesaler to feature five (5) different ensembles of furniture – in fact, he obtained 15 pieces of indoor/outdoor furniture for $1,100 so he could sell his sunrooms fully furnished for the same price as his competitors’ empty rooms. After that, he determined he could wire the rooms for surround sound for nearly nothing (they were already building the walls & ceiling, so wiring was easy). Then he added in a wall-mounted 55″ flat panel TV and a ceiling fan for a total of another $175 per room.

So, for just under $1,300 in margin, he could sell his fully furnished sunrooms for the same price as his competitors’ bare rooms. Did he take a little less margin? He certainly did – but he more than made up for it on a lot more sales volume. His increase in market-share overwhelmingly made up for the little less margin he took to dominate the business.

His compelling offer?

“Buy our sunroom fully furnished with your choice of 5 furniture ensembles, big screen TV, surround sound, and ceiling fan for the same price as their empty room.”

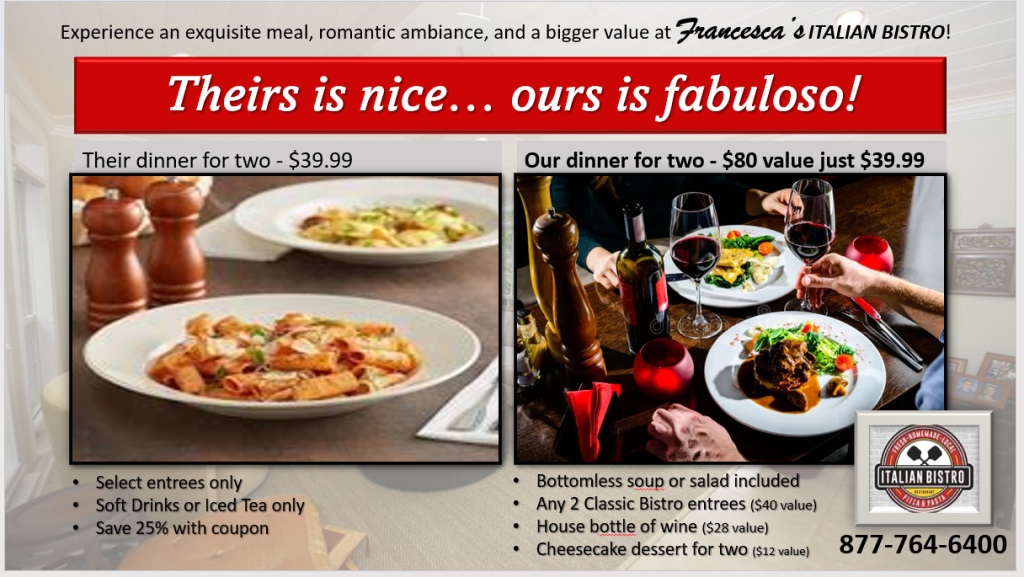

He showed pictures of his finished room fully furnished versus their empty room with the headline, “Not all sunroom builders are alike!”. So, if you’re in the market for a sunroom, which would you rather have?

Now THAT’S a compelling offer. Think like a consumer. If you were in market for a sunroom, which one would you choose?

This works for ANY business.

If you put your mind to it, maybe do some negotiating, you too can come up with an offer that’s more compelling than your competitors and thus increase your sales volume, market-share, and PROFITABILITY.

563.293.5930

With our online Business Academy any small-to-medium-sized business owner can learn how to

OUTSMART instead of OUTSPEND

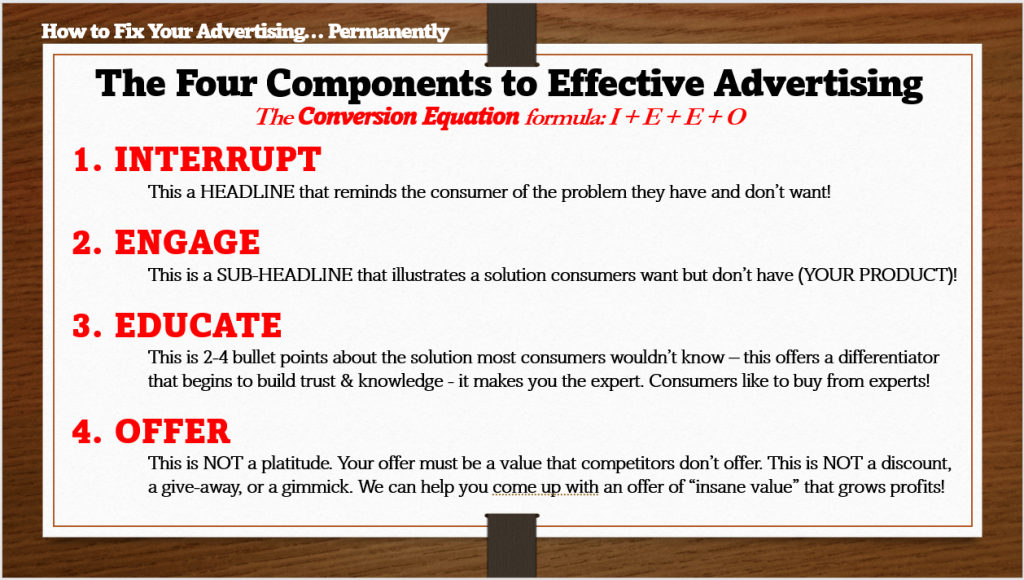

The Conversion Equation

I’m going to make this somewhat complicated subject simple – and the explanation brief so you can get on with business. But it’s important for you to understand. Using the Conversion Equation (below) in all your marketing is the difference between advertising and consistently effective advertising. No one locally is going to use this or educate you on it because they don’t know it themselves. This isn’t taught in marketing school, business school or by ad agencies or media companies.

“I know half my advertising is wasted. Problem is, I don’t know which half.”

– John Wannamaker | Philadelphia

(the father of modern department store business model)

The Conversion Equation was developed from 35 years of on-the-street marketing with small to medium sized business owners. It’s not used by Madison Avenue, Michigan Avenue, or Santa Monica Boulevard ad agencies because their clients are primarily branding – not direct response like you want if you want to sell your products and services. You don’t have to take my word for it. Try it. What have you got to lose?

If you need more help in how to fully leverage the Conversion Equation, give us a call at 563-293-5930 or click here to schedule a 15-minute conversation online with one of our Senior Advisors. The call is free.

Do You Have a $25,000+ Package to Sell?

Strategy eats tactics for breakfast… and tactics put runs on the board (money in the bank) quickly – Karl Bryan

Whether you like it or not, every business sells – every business. If you don’t sell something (or think you don’t), you don’t have a business. What you have is an expensive and time-consuming hobby.

So, based on the fact we all are in the sales business, do you have a $25,000 item or package you sell?

Every time I ask that question, I get silence, then an excuse. “I’m a CPA”, or “I’m a florist” or whatever. It really doesn’t matter if you’re a butcher, baker, or candlestick maker, you need a $25k, $50k, or, depending on your business, a $100,000 package of services and/or items to sell.

Will you sell a lot of them? Probably not. But, what you will sell a lot of will be your most profitable items under that category.

When my son was a little boy, he taught me an Elmo song from Sesame Street. Elmo was half-way up the stairs. Elmo acknowledged that he wasn’t at the bottom and he wasn’t at the top. Why, because “in the middle” is where most people feel comfortable. So was Elmo.

So, what does this story have to do with a $25,000 package? Plenty.

You see, most every business owner knows the easiest sale is to a current customer. Getting more transactions from current clients is a way to skyrocket your profit. Yet, most business owners make no discernable effort to do so.

Take the Florist for example: The florist sees most men only a few times per year… wife/gf’s birthday, Valentines Day, Anniversary, and Mother’s Day. Yet, the Florist typically makes a sale on only one of those occasions, not all four.

What would happen if that Florist offered a VIP package that automatically sent flowers to that special someone three or four times per year covering all the dates important to her (plus maybe mail or email a signed card or sent a smaller bouquet AUTOMATICALLY for other occasions so it’s never late or forgotten) but the guy paid only once – annually? Or, he could make 4 quarterly payments, hitting his American Express automatically.

Not every guy would buy it, but that’s not the point. Say two out of ten agreed to participate in the Florist’s new VIP Plan. That’s 2 or 3, maybe 4, more transactions per year with no marketing costs. What if the Florist saw 100 men walk-in to the flower shop on each one of those special occasions and closed 20 on on a VIP package each holiday?

That’s 80 new sales each year. So, 200% to 500% increase in sales simply by being prepared and asking.

Say, hypothetically, the Florist’s profit margin was $300 on each package. That’s $300 x 80 new VIP packages = $24,000 annually and ALL profit. Not huge money, but not bad simply for putting some thought into their clients situation.

Now, realistically, most Florists are not going to sell $25,000 to men, but they certainly could to companies. Maybe not sentimental occasions (or maybe they could – who knows?), but companies have board meetings, staff celebrations, company milestones, etc.

Let’s say you’re an accountant. An accountant could easily sell $25,000 packages of their services. Individuals and small business owners see you to prepare their taxes. For small business owners, do you provide advisory services just once per year? Of course you don’t.

But, if you packaged in quarterly reviews, financial planning, tax assessments, financial book archiving, benefit plan reviews, and all the necessary and advisable items a CPA needs to deal with to keep clients compliant and all done in a neat, calendared package, you think business owners would buy it? I know they would. We help them with it all the time.

You see, the point is, a lot of your customers don’t know what they need or that you offer it. Bundling products or services that naturally make sense for the client also make sense for your business and your profit.

I’m sure you get the point. All it takes is some thought and a little planning. When you sell your first four $25,000 packages and put a newfound $100k on the books, you’ll not only be amazed as to how easy it really was, you’ll wonder out-loud “How come I didn’t do this sooner”?

Let us know if you need some help developing ideas! Good luck.

22% Increase in Pay for Just One No-Cost Idea

Most every business owner knows the easiest and most cost-efficient sale is to a current customer. The customer already knows the business, they trust them, and like them… all the ingredients necessary to make a sale. Getting more transactions from current clients is a way to skyrocket your profit. Yet, most business owners make no discernable effort to do so.

Let me give you an example of how one no-cost idea can lead to a 22% increase in pay for a small business owner that wants to take the time to get tactical in their business.

Take a Florist for example: The Florist sees most men only a few times per year… wife’s birthday, Valentines Day, Anniversary, and Mother’s Day. Yet, the Florist typically makes a sale on only one of those occasions, not all four. The Florist typically doesn’t take the man’s name or email address for further communication (like a drip campaign) and sales opportunities. The Florist makes the sale in front of them and hopes the man comes back again in the future.

That’s what is called a Linear sale. And it’s pretty typical.

Unfortunately, this is a prime example of linear growth or decline most small business owners are also stuck in.

While we deal in exponential growth, the scenario I’ll explain below is only one very basic element of exponential growth. Let’s see how it plays out for a Florist using some industry averages.

What would happen if that Florist offered a VIP package that automatically sent flowers to the men’s special someone four or five times per year covering all the dates important to her (plus maybe mail a signed card or email an e-card or send a smaller bouquet AUTOMATICALLY for those other occasions so it’s never late or forgotten) but the guy pays only once – annually? Or, he could make 4 quarterly payments, tapping his credit card automatically.

Not every guy would buy a $400 VIP package, but that’s not the point. Say two out of ten agreed to participate in the Florist’s new VIP Plan. That’s 4, maybe 5, more transactions per year with no marketing costs. What if the Florist saw 100 men walk-in to the flower shop on each one of those special occasions and closed 20 on on a VIP package each holiday?

So, 400% to 500% increase in that category of sales simply by being prepared and asking.

The average margin for flowers is 75%. Say, hypothetically, the Florist sold these VIP packages at $400 each. That’s a gross profit margin of $300 on each package. That’s $300 x 80 (20 men X 4 occasions = 80) new VIP packages or $24,000 annually.

At an average net profit of 20% of revenue, that’s $6,400 annually. While not huge money, when you consider the average Florist’s income is $29,195, that $6,400 profit amounts to a 22% pay increase for the owner.

I’m pretty sure a Florist making $29,195 per year would jump at the chance to make $35,595 if the cost to do it was $0. This is just one simple idea of many that costs absolutely nothing to initiate. All it takes is a little thought and preparation.

Additionally, as these holidays are recurring, so the income will also be recurring.

As mentioned earlier, this is just one example of how to grow your business exponentially. When you add in cross-selling (“Would you like fries with that?”) and upselling (“Would you like that super-sized?”), now you’re impacting multiple areas that compound growth.

McDonald’s saw how simply asking, they sold more large fries and more large drinks simply by asking – adding billions of dollars to their bottom-line. If a sixteen-year-old kid working the counter at McDonald’s can do it, so can you.

If you need help, let’s talk or go here to download my book for FREE that tells you everything you need to know to find $10,000 in your business without spending another dollar in marketing or advertising.

You can also click this link to take a guided tour of our Do-It-Yourself E-Learning Marketing System

If you want to see how we’ll find more than $100,000 in new recurring revenue in your business without spending another dollar in marketing or advertising, watch this brief video to see how we do it and how we’ll do it specifically for your business for FREE!